Econometrics and time series analysis

Econometrics is the collective term for empirical research in economics. Within the framework of econometrics, an attempt is made to find the shoulder-to-shoulder connection between practice and theory. Starting from theoretical considerations, the procedures of econometrics are to confirm or reject this theoretical basis with numbers & data.

Time series analysis

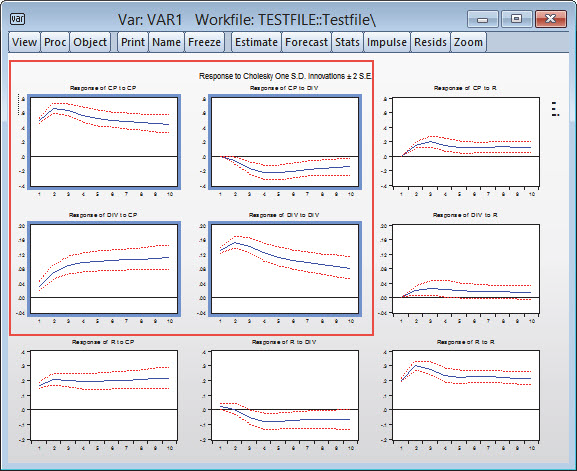

Typical for many economic problems is a time component. How do returns evolve? What happens to certain prices over the year? Depending on the industry, these questions have very different meanings. For statistics, they all have a common structure: the core of the problem is a change over time.

Accordingly, there are a number of methods - ARIMA or linear regression models, to name just two examples - that deal with describing trends in time series, discovering correlations between different time series, or even producing predictions that are as valid as possible.

Panel data analysis

Panel data analysis - also known as longitudinal data analysis in biostatistics - is a statistical method widely used in the social sciences, epidemiology, and econometrics to study two-dimensional statistical data. Often, one dimension is given as time, and the second is given by the category "individuals." In these cases, panel data analysis can be understood as a natural generalization of simple time series analysis. Advantages of panel analysis compared to simple time series analysis are the increased flexibility, compared to simple cross-sectional analysis the improved possibilities to detect causalities.

Financial Mathematics

Financial mathematics as a discipline of applied mathematics deals with problems from the financial sector, especially those from the banking sector. Central to the importance and development of financial mathematics are certainly the two fundamental theorems of price theory, which describe the arbitrage-free nature of markets and the hedgeability of risks through the existence and uniqueness of martingale measures and thus provide formal answers to two central economic questions.

The field of financial mathematics has developed rapidly over the last 3 decades: classical models such as those of Black/Merton/Scholes or Cox/Ross/Rubinstein have been generalized and supplemented by more flexible models, which can be computed approximately due to the high computing power of today's computers. In this context, Monte Carlo simulations should be mentioned in particular, which - in contrast to deterministic methods - also allow the calculation of high-dimensional models.

Actuarial Science

Actuarial science deals with the subject area of risk assessment. Risks are quantified using mathematical and statistical methods.

The field is highly interdisciplinary, as the management of any major company is based on adequate risk assessment. Banks and insurance companies play an (economically) supporting role. For them, actuarial topics such as "valuation of guarantees and options" or "hedging of risks" are essential and can be dealt with using actuarial tools such as Monte Carlo simulations or actuarial equivalence principles.